[Citizen College Season 3] Political Economy of International Finance and Money in Northeast Asia

On November 29, 2019, the 11th lecture of the Citizen College Season 3 “Citizens and the World: Peace on the Korean Peninsula and International Politics” was given at Korea University’s Political Science & Economics Bldg. 101, jointly by Seongbuk-gu Office and the Korea University Institute for Peace and Democracy. The eleventh lecture was given by Lim Kyu-taek, a professor at the Institute for Peace and Democracy at Korea University.

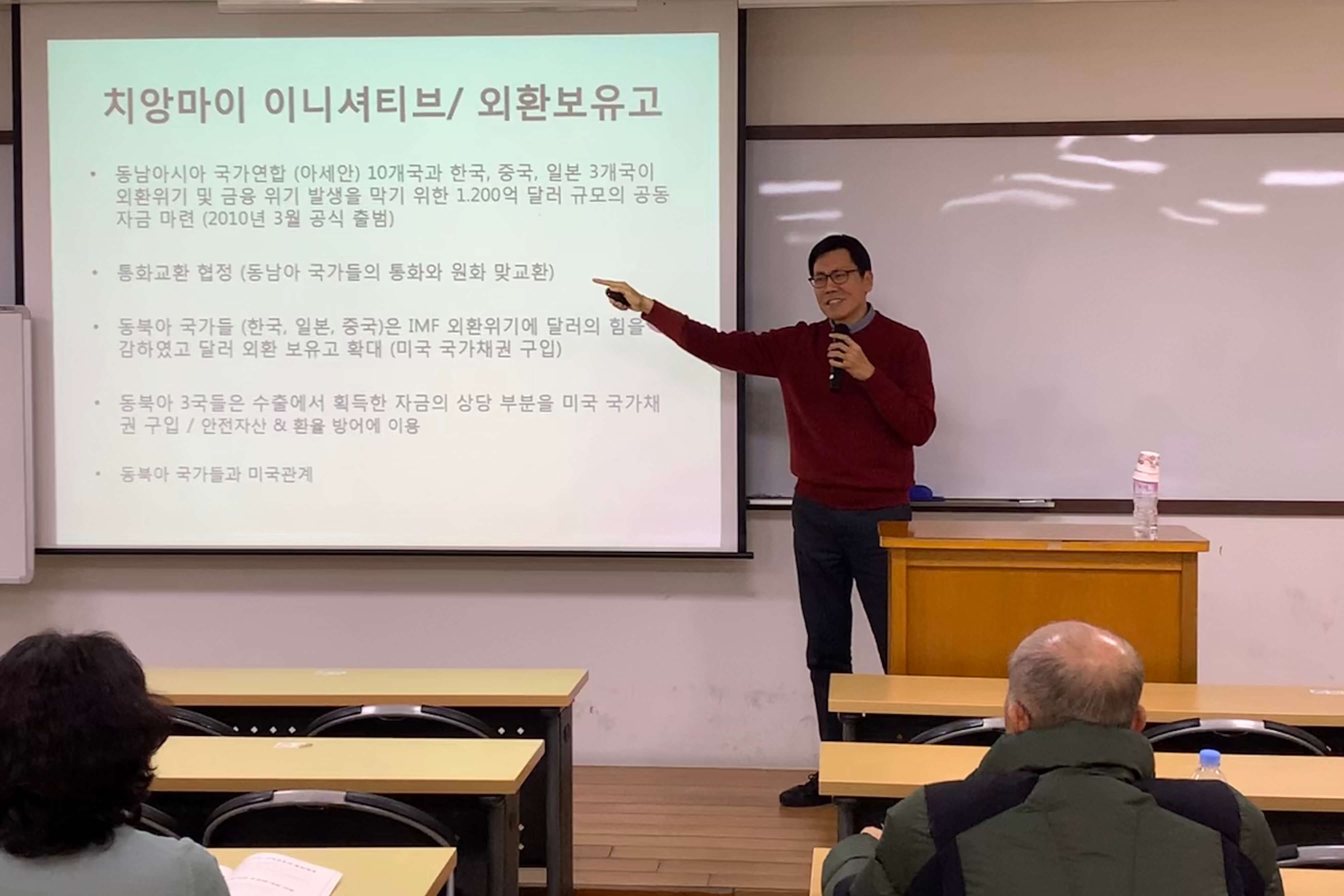

Titled “The Political Economy of International Finance and Money in Northeast Asia,” it was a time to explore the international financial system and various financial crises formed in the international community after World War II and take an international political and economic approach to China’s rise.

After World War II, the Briton Woods system was formed. A fixed exchange rate system that pegs exchange rates in each country to the U.S. dollar/gold, with limited capital movements and financial markets regulated. Since 1971, Britain’s system has been dismantled, and the Post-Britain Woods system has been established. A country’s exchange rate will be affected by external environment and internal political and economic factors (variable exchange rate system). With the opening of the financial market and eased regulations on capital movements, a financial crisis that did not occur in the Britain-Wood system began to emerge (the Latin American debt crisis in the 1980s, the Asian financial crisis in 1997 and the global financial crisis in 2007). Nevertheless, the dollar’s power, the U.S. financial market, was expanding further.

China has been growing rapidly for the past 20 years and emerged as the world’s second largest economy in 2013. Through one belt, one road projects, china is advancing into emerging markets in Asia and has established and operated the Asian Infrastructure Investment Bank (AIIB). The AIIB was launched in 2016 with the participation of 37 Asian and 20 non-Asian countries and is an international financial institution with a capital of $100 billion. China’s financial power is felt in the relationship between China, Central Asia and African countries, but in the international financial market, China’s national banks have little impact on size. So China’s financial market development is uncertain. The Chinese government has been actively promoting the internationalization of the yuan since 2010. Although it has made significant progress in international trade, many countries and banks in the financial market are not actively using the yuan. Therefore, the speaker predicted that the internationalization of the yuan would not be smooth either.